Note: this site and the author does NOT have any financial relationship with any of the service providers being reviewed.

THREE POINT OVERVIEW:

1.) I created an AI workflow to retrieve new loan issuance data from BDC filings to help me stay on top of direct lending loan issuance trends on a quarterly basis.

2.) NotebookLM is a powerful tool that was quite useful here, outperforming Claude Opus 4.5 in data retrieval accuracy.

3.) While many view NotebookLM as only an online/chat interface, there are very useful Excel and PDF export features (but figuring out how to use all of them is not very intuitive!).

INTRODUCTION:

Why this workflow is useful to me: throughout the parts of my career where I was in a public markets seat, I always wanted to find a repeatable, low-effort/cost way to stay on top of new issuance trends/pricing in the private credit market (specifically in large-cap direct lending) without waiting for or relying exclusively on external research. From a performing public credit lens, I always found this relative value data to be useful in my process - for example, buying a single-B rated bond at a +300bp spread feels like a better trade when large-cap direct lending unitranches at the tight end are being priced at S+450 (vs. when they are at S+600). Similarly, when pricing distressed or equity type risk, it’s useful to have a sense of where mezzanine and preferred tranches are being priced in the private markets.

A good way of staying on top of these datapoints is monitoring new loan additions to BDC portfolios. For those that aren’t part of the “credit mafia”: BDCs (short for Business Development Companies) are investment vehicles that predominantly invest in private credit loans and are some of the largest holders of direct lending assets in the market - we’ll spare you the details here, but many of these vehicles are publicly traded and have SEC filings that allow investors to view their portfolio holdings on a loan-by-loan basis.

The problem: analyzing newly issued loans in a BDC portfolio is not as simple as glancing through a 10-Q/K. The schedule of investments included in the 10-Q/K for a large BDC includes hundreds of line items (the largest publicly traded BDC has over 550 portfolio companies, and often holds several tranches of debt in the same cap stack!). What makes things even harder to analyze, is that portfolio positions are usually organized alphabetically by industry and not by acquisition date, and for some BDCs the acquisition date may not even be disclosed (so to identify newly underwritten loans, you need to compare hundreds of line items against the prior quarter).

News outlets and sell-side research frequently report only headline pricing trends (ie. direct loans on average were priced at S+500 to 525 in Q3 2025) or comment only on a few select deals, whereas combing through these SEC filings allows you to gain more granular insights into new issuance pricing trends across different industries and loan types. Bloomberg doesn’t really have a good way of cleanly pulling this for a particular BDC either.

The AI-driven solution: use NotebookLM or Claude on a quarterly basis to extract new loan issuance and pricing data from the financials of the two largest publicly traded BDCs (Ares Capital Corporation (ARCC) and Blue Owl Capital Corporation (OBDC)) and create easily digestible outputs in both Excel and PDF form.

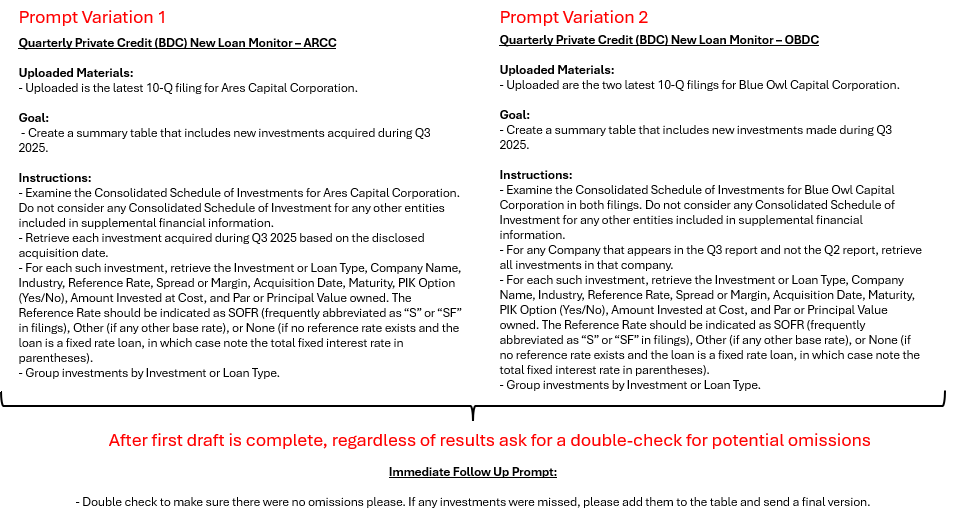

I show the AI prompt I used below (Figure 1). I used two slightly different variations of the prompt to accommodate the different reporting style of ARCC (loan acquisition dates disclosed) and OBDC (loan acquisition dates not disclosed, so comparison of the portfolio with the prior quarter is necessary). Most BDCs fall into one of these two reporting style categories, so these prompts should be widely applicable to other BDCs.

DETAILED INPUTS AND OUTPUTS:

I ran this workflow separately on both NotebookLM and Claude Opus 4.5 to compare results (under Pro subscriptions to both Gemini and Claude). I found the performance of NotebookLM from an accuracy and speed standpoint to be superior this time around, so most of this section is focused on NotebookLM outputs (but I do cover Claude at the end as well).

Before we review the outputs, in Figure 1 you can see the prompts that I used to extract data from ARCC and OBDC financials (text versions of the prompts that you can copy/paste are in the Appendix).

Figure 1: AI prompts used are shown here and pasted in text form in the Appendix. Along with the prompt I had to manually upload the 10-Qs and upload to both NotebookLM and Claude (NotebookLM cannot pull PDF files from web and Claude had a lot of trouble retrieving from EDGAR)

NotebookLM Outputs:

NotebookLM was quite good at running these prompts and extracting the correct data. I ran these prompts around 10 times and spot checked the results each time - sometimes the first draft would miss ~5 new loans out of 100+ new loans, but running the “double-check your work” prompt immediately after the first draft (regardless of results) made the output quite accurate in NotebookLM based on my spot checks.

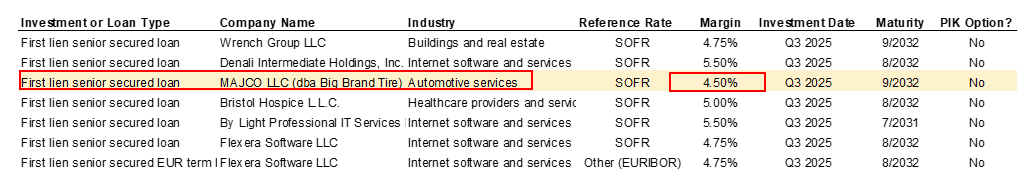

Partial screenshots of the outputs exported to Excel are below (Figure 2 and Figure 3). In the captions we briefly touch on some of the takeaways you can gain from this data. (Yes, the data is delayed by at least a month (reporting lag) and we can debate some of the intricacies around the datapoints (for example, that some of the “new loans” are delayed draw loans that were underwritten in past periods and “acquired” in the current period, but there are ways to filter this out which we won’t get into here).

But regardless, in my opinion you can still get a pretty good read on the market using this information.

Figure 2: Partial ARCC Output. Here are some interesting things you can see right when the 10-Q is posted: 1L unitranches being priced as low as S+425-450 (!), Nexus Buyer 2L deal priced at S+575 (which is a +225bp spread over the 1L broadly syndicated tranche), while subordinated/pref risk is being priced in the 12-15% range w/ PIK.

Figure 3: Partial OBDC Output. Also showing 1L risk priced at S+450 at the tight end.

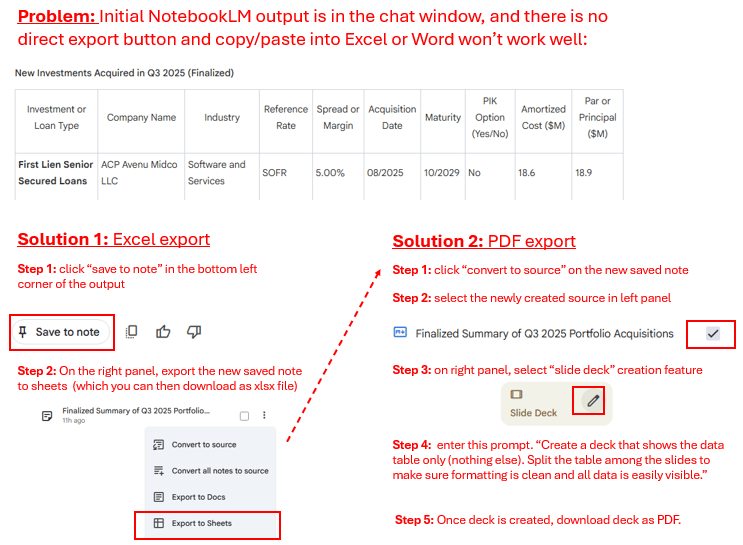

Important note: exporting data tables out of NotebookLM into Excel or PDF format is a little bit tricky and unintuitive. I’ve read complaints about NotebookLM completely lacking these features - but the reality is this functionality does exist but is hard to find. So below is a guide to getting these exports to work (without installing plug-ins or trying to copy/paste data (which doesn’t work well)).

Figure 4: How to export table outputs from the NotebookLM chat window to Excel or PDF. A bit more tricky than you’d expect…

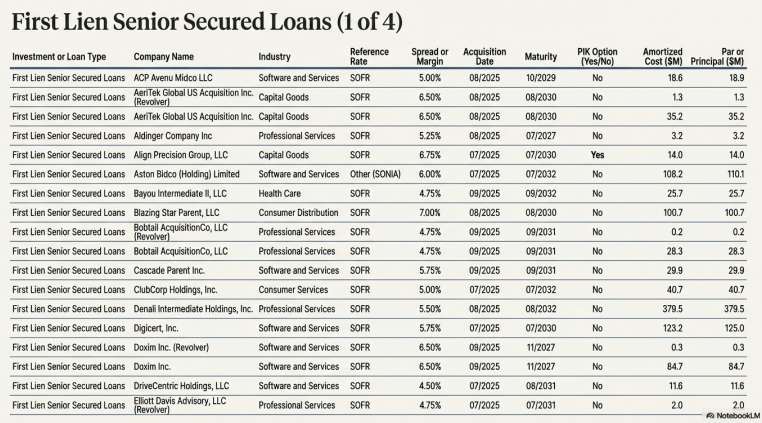

While not intuitive, the end result of a tricky PDF export process (Chat Output → Save to Note → Convert to Source → Create Slide Deck w/ Custom Prompt → Download Slide Deck as PDF) works quite well if you want the table in a neat PDF format. First page of the exported PDF deck is below (Figure 5).

Figure 5: Exported PDF deck is pretty good for my purposes

Claude Opus 4.5 Outputs:

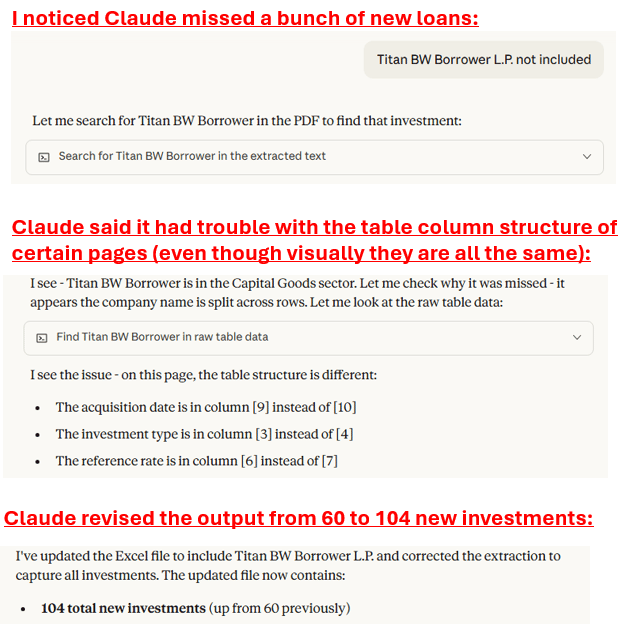

Claude was much less consistent in terms of accuracy in our test runs of these prompts and was generally slower (would think for ~10-15 minutes vs. ~5 minutes or less for NotebookLM) - so we won’t go too deep into the output screenshots here. The main issue was that it had trouble processing certain pages of the 10-Q PDF - I think something in the code structure of the PDF was throwing Claude off (it noted trouble with different column structures on certain pages, even though visually the investment schedule table was the same across all pages). In Figure 6 below, I show an instance of where Claude only pulled 60 of ~100 new loans until I pressed it on the omissions.

So overall, some room for improvement for Claude Opus 4.5 on these fronts. That’s why we’ve focused on the NotebookLM outputs - it did a better, more consistent job here and is in my opinion kind of an underrated tool (I see “Claude is AGI” hype everywhere on X (probably more due to Claude Code), but NotebookLM is kind of slept on…)

Figure 6: NotebookLM performed better than Claude Opus 4.5 in this workflow

CONCLUSION:

Thanks for reading. Take these prompts out for a spin next time the BDCs report earnings in a month or so!

If you found this helpful, I would really appreciate if you subscribed and shared this site or my posts on X with anyone else who may be interested in reading. My hope is that more scale will help me convince some of the larger AI service providers to let me onto their platforms to review their services for you guys (for now they aren’t responding to my emails!).

APPENDIX:

See below for text version of prompts that you can copy and save for yourself:

Prompt Variation 1:

Quarterly Private Credit (BDC) New Loan Monitor – ARCC:

Uploaded Materials:

- Uploaded is the latest 10-Q filing for Ares Capital Corporation.

Goal:

- Create a summary table that includes new investments acquired during Q3 2025.

Instructions:

- Examine the Consolidated Schedule of Investments for Ares Capital Corporation. Do not consider any Consolidated Schedule of Investment for any other entities included in supplemental financial information.

- Retrieve each investment acquired during Q3 2025 based on the disclosed acquisition date.

- For each such investment, retrieve the Investment or Loan Type, Company Name, Industry, Reference Rate, Spread or Margin, Acquisition Date, Maturity, PIK Option (Yes/No), Amount Invested at Cost, and Par or Principal Value owned. The Reference Rate should be indicated as SOFR (frequently abbreviated as “S” or “SF” in filings), Other (if any other base rate), or None (if no reference rate exists and the loan is a fixed rate loan, in which case note the total fixed interest rate in parentheses).

- Group investments by Investment or Loan Type.

Prompt Variation 2:

Quarterly Private Credit (BDC) New Loan Monitor – OBDC:

Uploaded Materials:

- Uploaded are the two latest 10-Q filings for Blue Owl Capital Corporation.

Goal:

- Create a summary table that includes new investments made during Q3 2025.

Instructions:

- Examine the Consolidated Schedule of Investments for Blue Owl Capital Corporation in both filings. Do not consider any Consolidated Schedule of Investment for any other entities included in supplemental financial information.

- For any Company that appears in the Q3 report and not the Q2 report, retrieve all investments in that company.

- For each such investment, retrieve the Investment or Loan Type, Company Name, Industry, Reference Rate, Spread or Margin, Acquisition Date, Maturity, PIK Option (Yes/No), Amount Invested at Cost, and Par or Principal Value owned. The Reference Rate should be indicated as SOFR (frequently abbreviated as “S” or “SF” in filings), Other (if any other base rate), or None (if no reference rate exists and the loan is a fixed rate loan, in which case note the total fixed interest rate in parentheses).

- Group investments by Investment or Loan Type.

After first draft is complete, regardless of results ask for a double-check for potential omissions:

Immediate Follow Up Prompt:

- Double check to make sure there were no omissions please. If any investments were missed, please add them to the table and send a final version.