Note: this site and the author does NOT have any financial relationship with the service provider being reviewed.

THREE POINT OVERVIEW:

1.) Portrait Analytics is an AI-powered research platform that assists public equity investors with idea generation, deep research, and position monitoring. The founding team incorporated investing experience at Baupost and Slate Path to design a platform that addresses some of the limitations and frictions of using general-purpose LLMs for investment research.

2.) Portrait features a built-in document library (including SEC filings, presentations, transcripts, and integration with Third Bridge expert network transcripts (separate subscription necessary; more expert network integrations coming). This library is utilized to create higher-quality, traceable outputs. Users also have the ability to toggle whether the platform accesses online news sources and web search results (where Portrait has done work to prioritize reputable content over internet noise). Portrait uses a mix of its own trained tools/functionalities and general-purpose LLMs to analyze the document library and web sources (if turned on). As part of the process on the back end, the platform breaks down tasks into sub-components and then routes these tasks to the best fit LLMs.

3.) After using Portrait over the past week, I found it to be very useful for identifying interesting set-ups, getting up to speed on “the story” of new names, and framing what one needs to believe for a trade to work. I think Portrait is best used as an assistant to an analyst, allowing the analyst to spend less time gathering and summarizing information for desktop research and more time (i) building/drilling down into a granular model and forecast scenarios if the idea is worth the time (note: Portrait is not a modeling tool) and (ii) driving additional research workflows (including further deep research + alternative data + “boots-on-the-ground” research) to dig further into the initial insights from Portrait.

DETAILED REVIEW:

I tested out Portrait’s Case Study, Screening, Deep Research, and Monitors features. Let’s go through each, with screenshot examples of the outputs.

1.) Case Study Feature:

This functionality is simple but very handy. It allows you to click through a historical price chart for a stock on a quarterly basis to get a quick download on the key events and narratives during each period. We’ll use Charter Communications (CHTR) as an example here (Figure 1). We can see that there was a sharp sell-off in Q1 2024, so when we click into that period, Portrait shows that there was a big miss on broadband net adds (-61k) vs. consensus (+12k), as shown in Figure 1. In hindsight, this was the first quarter of negative broadband net adds for CHTR and these declines have persisted since. Clicking through a time series like this is a pretty helpful way to gain an understanding of the “story” around a stock and its past movements.

As an analyst it was always burdensome to create annotated price charts with key news/events, so this feature can certainly streamline that task.

Figure 1: Portrait’s Case Study feature allows you to quickly get up to speed on the “story” of a stock by clicking through it’s chart.

2.) Screening Feature:

This functionality allows you to screen for new ideas using a combination of quantitative and qualitative criteria (via semantic search) to identify companies that fit a certain theme or trend. You can build custom screens, but in the interest of time I only tested out some of the pre-loaded screens in the system.

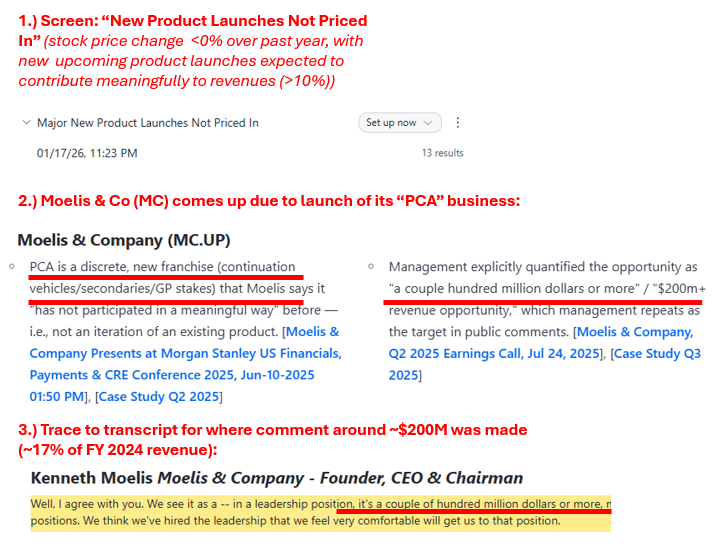

As an example, one of these pre-loaded screens was titled “New Product Launches Not Priced In”. This screen combined quantitative criteria (stock performance <0% over past year), with qualitative criteria that narrowed the search to companies that “…will soon be launching, or have launched within the most recent quarter, a discrete, significant new product, which has large upside potential for the entire company…and management must have explicitly quantified the expected opportunity from the launch, which must represent >10% of existing company revenue”

Moelis & Co (MC) is a company that comes up on this screen (Figure 2) - they launched a new secondaries/fund-level financing advisory business in 2025 and made some significant new hires for that franchise. This screen picked up management describing the opportunity as “a couple hundred million” on the Q2 2025 earnings call which would represent~17% of the revenue Moelis reported in FY 2024. Given the state of the private markets (exits hard to come by) this does seem like a pretty big potential opportunity at first glance (but perhaps the offset is a decline in traditional M&A volume/fees?). Either way, pretty interesting as this is not something that would have been picked up in a simple quantitative Bloomberg/CapIQ screen.

Figure 2: Sample Moelis & Co outputs from the screen. Portrait allows you to expand screening beyond traditional quantitative-data-only screens.

3.) Deep Research Feature:

Within the deep research feature, users can input their own custom prompts or access a library of (very) detailed “pre-loaded” prompts that are formulated to create outputs that have the information + logic + structure an institutional equity investor would require. Users can also a “magic button” feature to transform their short, high-level prompts into ones that feature the same level of detail and structure as the “pre-loaded” prompts.

To explore the deep research functionality, let’s once again back to CHTR. CHTR is a pretty complex situation from an operational/competitive standpoint (battle against persistent broadband subscriber share loss due to FWA and fiber competition), as well as a corporate/M&A standpoint (there is an upcoming merger with Cox expected to close mid-2026 and a significant share repurchase transaction that effectively collapses the Liberty Broadband Structure into Charter scheduled to close concurrently with the Cox transaction).

Portrait can be used to get up to speed on the situation in a pretty low-effort way by using the detailed built-in prompts. For example, the “Long Pitch Memo” prompt is over 1,000 words long and includes 4 investment thesis examples to make make the required output clear. Here are how the built-in prompts are set up on the platform (Figure 3).

Figure 3: The built-in prompts allow you to get high quality outputs from AI in a very low-effort way. These built-in prompts are up to 1,000+ words and include multiple examples that clarify to the LLMs what a good output looks like.

I ran the “How a Company Makes Money”, “Long Pitch Memo” and “Short Pitch Memo” built-in prompts with just a few clicks to see how well Portrait could get me up to speed on the situation.

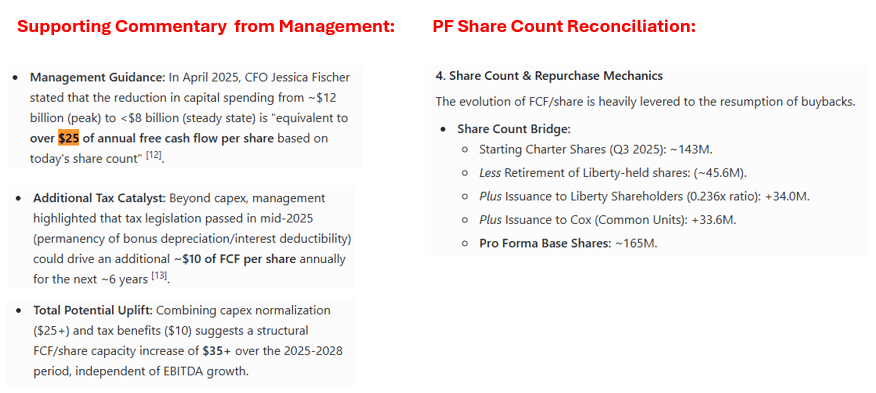

Let’s talk specifically about the “Long Pitch Memo” for Charter. I found it to be quite good for framing the investment case for CHTR and captured a lot of the nuances that I was looking for. It acknowledged the broadband subscriber growth challenges, but laid out the bull case as follows: to the extent Charter can maintain stable revenue/EBITDA despite weak sub trends (as it has been doing via mobile bundling and speed uptiering), a step down in capital intensity (which management has guided for) should lead to $25/share of incremental FCF, which combined with $10/share in expected annual tax benefits, could more than double cash flow per share to over $70/share over the next 2-3 years relative to a sub-$200 stock price (ie. stock trading at <3x implied LFCF multiple today). In the bull case, this cash flow inflection may coincide with an opportunity to take back broadband share to the extent FWA capacity cannot keep up with bandwidth demand over the next few years (a reversal or slowdown of sub losses for CHTR would do wonders for sentiment).

Portrait’s 2-year forecast took into account the Cox and Liberty broadband transactions using disclosures in investor presentations and proxy materials, and produced PF 2026 and 2027 estimates (Figure 4) that were directionally right in framing the trade (I do moderately disagree with some of the forecasts, but overall this was a good directional overview of “what might the upside case look like on the long side?”). The below is not a functional model by any means, and I would certainly prefer flexibility to adjust forecasts within the memo directly on a real-time basis, but this does frame the bull case well. As I’ll show later, this is not the same kind of output I got using a general-purpose LLM.

Figure 4: the 2-year forecast assumed a Jan 1, 2026 PF close date for the Cox and Liberty Broadband transactions. The forecast was directionally right and laid out the bull case quite well.

The analysis included key quotes from management (Figure 5) that support the projected FCF-step up, which is a core pillar of the long thesis. The memo also included a section that outlined the forecast assumptions and included reconciliations for items such as the PF share count, which took into account the expected impact of the Cox and Liberty Broadband transactions (though I think the starting diluted share count should be 148 million instead of 143 million as of Q3 2025, so further prompting would be necessary to get to the exact assumptions/sources behind Portrait’s share count math).

Figure 5: Example of some of the management commentary and reconciliations included in the analysis.

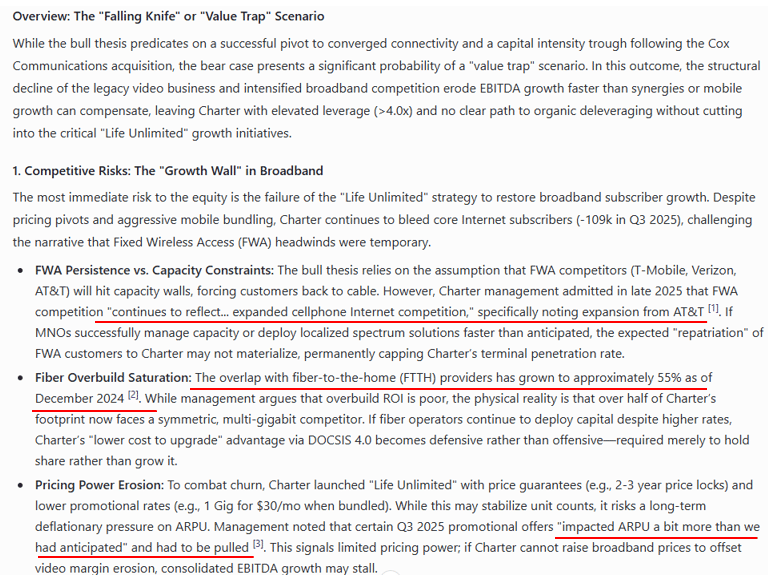

The “post-mortem” section of the report covered what might go wrong with an investment in CHTR pretty well (Figure 6) and included citations to relevant quotes/datapoints. As a next step in the research process, I would want to dig into further into all of these points, as well as mobile unit economics and defensive tactics telcos can take to migrate FWA subscribers to fiber, via additional industry-level deep research prompts in Portrait (which would pull in relevant info across the cableco/telco space).

Figure 6: Risks section addressed the main drawbacks I see in the CHTR story - all of these points should be researched via additional deep research prompts (with an industry-wide focus).

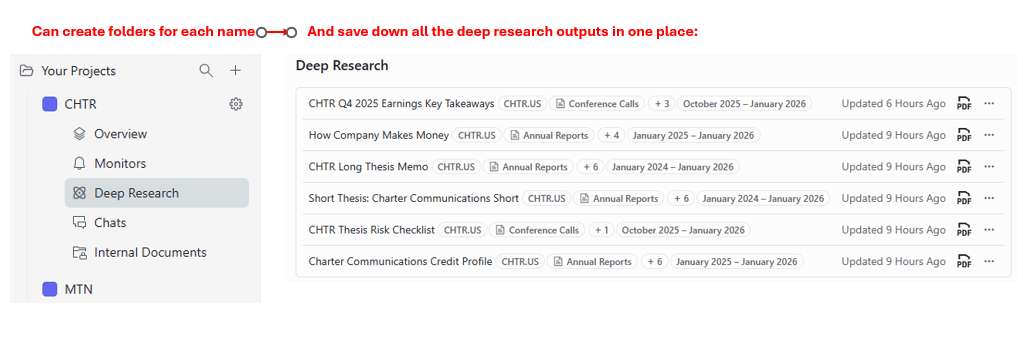

This “Long Pitch Memo” prompt can be combined with other built-in prompts (including a “Short Pitch Memo” which explores the other side of the CHTR debate in more detail) to form a “get up to speed workflow” within Portrait. For each name, you can save all of the deep research outputs in a separate folder just like I did for CHTR below (Figure 7). The platform has a user-friendly interface and a simple file organization system that makes it easy to categorize and store deep research outputs for future reference.

Figure 7: Portrait makes it quite easy to categorize and save all of the deep research outputs by project.

I feel like every buyside analyst has experienced beginning the research process on a new name and looking up some sell-side initiation reports for a quick download - only to find that the most recent initiations were from 5+ years ago… Portrait helps solve this problem.

In terms of future improvements to the deep research feature, while the overall accuracy is good and there are broad citation features, I hope that over time the ability to trace the exact source/calculation methodology for each specific number in the financial exhibits individually will be added. In addition, the ability to edit and change forecast assumptions in the financial exhibits on a real-time basis within a memo would be a really cool functionality to have.

BONUS: Testing Gemini 3.0 Pro Deep Research vs. Portrait Deep Research:

As a test, I ran the same 1,000+ word “Long Pitch Memo” prompt through Gemini 3 Pro (deep research mode). Gemini was able to do a decent job at explaining some of the cable broadband vs. FWA vs. fiber competitive dynamics, but its inability to access and/or process all the necessary/significant information resulted in the memo missing some very key aspects of the CHTR situation.

The biggest problem was that Gemini’s memo missed the Cox acquisition and Liberty Broadband transactions entirely (Figure 8). This is despite the Cox and Liberty Broadband transactions both being referenced several times in the Q3 2025 earnings release - which Gemini listed at the top of the list of sources for its memo!

Figure 8: Gemini did not take the Cox acquisition into account at all (even though it is expected to close mid-2026).

Another weakness of Gemini’s memo, was that while the output mentioned declining capex intensity, it did not include any of the strong supporting commentary from management, which makes sense due to lack of access to transcripts.

The Gemini memo is a good example of general purpose LLMs creating an output that looks and sounds professional but misses some very key details/nuances of complex investment situations.

4.) Monitors Feature:

Setting up a Monitor within Portrait allows you to receive real time alerts on new information that supports/refutes a thesis or is relevant to a watchlist that you are monitoring (you can adjust the scope of the alerts as needed). The monitor will pick up any new relevant datapoints that appear in the Portrait library (ie. transcripts/presentations etc. across industries), as well as relevant news items, with the goal of only including material datapoints (unlike Google and Bloomberg alerts which don’t have great materiality filters and from personal experience can be very overwhelming). Figure 9 below shows a sample of the alerts that a user might get upon setting up a monitor for a high-level industry-level thesis such as “adoption of AI will drive robust and growing demand for energy / power”.

Figure 9: Setting up thesis monitors is very easy within Portrait

CONCLUSION AND NEXT STEPS:

My overall impression is that Portrait is a useful platform that is easy to integrate into an existing research process. If you’re an institutional equity investor who is (i) looking for plug-and-play AI functionality, (ii) wanting to avoid dealing with an arduous AI integration process, and/or (iii) struggling to get reliable outputs from general-purpose LLMs, you should try it out. Find out more about Portrait here.

Once again, this is not a sponsored post. The purpose of these write ups is simply to highlight useful AI platforms for investment research and provide real examples of their capabilities.

That’s all for today. Thanks for your attention, and stay tuned for more finance-specific platform reviews and write ups on AI workflows. If you found this helpful, please share with anyone else who may be interested in reading!